The Poor Little Rich Kids

Oh how sad, how stressful it must be to be filthy rich these days.

What?? Why are you giggling hysterically, dear reader and eater? Has someone slipped some nitrous oxide into your luxurious, tasty Ya Udah Bistro pasta? No? If not laughing gas then what gives rise to your ironic belly-laugh?

The wealthy connive, cheat, lie, suck up to and swindle everybody else to amass their fortunes, Pfennig by Pfennig, Ruble by Ruble …

… Dong by Dong [insert porno picture here].

In order to avoid any possible misapprehension, I am not talking about ‘The Donald “Rich”’. (HINT: The solid-gold chair’s made of wood and painted gold).

(‘OPM’: SECRET TO THE ‘TRUMP FORTUNE’)

Up until the Turn of the Millennium Donald Trump was a kind of a joke in New York. Actually, the whole clan was a joke family: the grandfather was a whoremaster, his father a slumlord and ‘The Donald’ (as Ivana, his exotic imported wife, referred to him) declared bankruptcy so often (losing daddy’s bloody money) that it would make your head spin. His specialty was ‘legal money-laundering’: helping rich [corrupt] Russian oligarchs hide their money through Manhattan real estate purchases, bait-and-switch real estate deals where investors are left holding the bag – but legally [barely]. And outright scams like ‘Trump University’ which wound up its academic excellence by coughing up $25 million to pay off unhappy ‘students’.

Since 2017 the joke has been on his fellow New Yorkers, as The Unexpected President scored an upset defeat, snatching the election away from Madame ‘It-is-my-turn-now’ Clinton (though she scored three million more votes than he did – so much for the U.S.A. as a ‘democracy’). He roared into the White House like it was another reality show, which in a sense it has become, after eight years of ‘steady as she goes … don’t rock the boat … Obama.

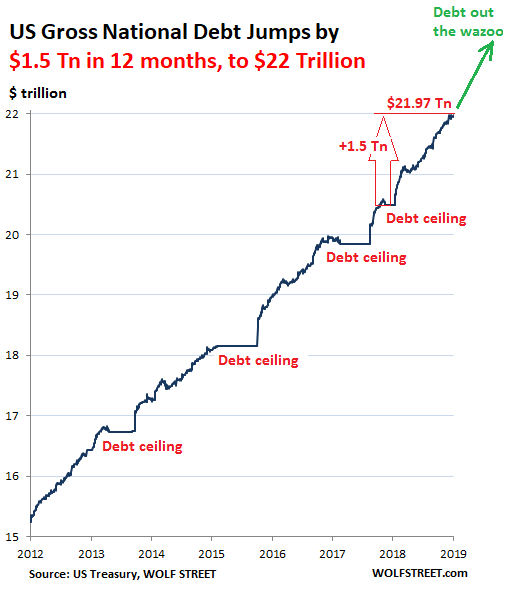

With such flashy over-the-top style and wretched taste, Donald Trump is (as someone astutely remarked) what a poor person thinks a rich person looks like. Meanwhile, he and his billionaire pals are making the rich richer and loading up on more debt, while saying what his bewildered and impoverished base wants to hear.

Who bought all this ‘junk debt’? You’ll never guess. Prez ManBaby borrows more and more. When it comes time to pay it back? “I don’t care” he smiles. “I’ll be out of office by then.” A total grifter and cynic. But millions of voters still adore him and his MAGA fantasy.

As Vanity Fair contributing editor Fran Lebowitz commented: “He’s a poor person’s idea of a rich person … All that stuff he shows you in his house – the gold faucets – if you won the lottery, that’s what you’d buy.”

The display of “conspicuous consumption” is central to the Trump brand: gold is the colour of money and the finish of choice in his Manhattan penthouse and Mar-a Lago. The term “conspicuous consumption” was coined by 19th-century sociologist Thorstein Veblen to explain the extravagant displays of railroad millionaires and robber barons. Veblen argued that open acts of extravagant spending were a means of establishing the real or perceived power and prestige of individuals who held an otherwise precarious social position.

One important distinction (at least to some who follow the shenanigans of the rich) is old money vs. new money. The idea is the an established fortune is somehow more validating of a family name than the nouveau riche (think the plain Bill Gates with the bad haircut, the luckiest man in software and practitioner of questionable business practices, or the late – and not much missed – Steve Jobs, whose interpersonal skills were those of a petulant nine-year-old).

One popular assumption is that all rich people (or at least the forebears who left them money) have bent if not broken the rules to amass their wealth. Or, to put it bluntly:

Is this an accurate generalization? Mario Puzo used this quote to introduce his novel ‘The Godfather’ and it certainly applies to organized crime, or the Mafia, the Chinese triads …

… the Colombian and Mexican narcotraficantes. They are outstanding examples of contemporary criminal enterprises amassing great wealth. (Billions from the drug lords, by the way, kindly deposited in panic-stricken banks, were alleged to have saved many from closing during the 2008 krismon)

This sort of wealth, such as was amassed by the notorious KKN (corruption / collusion / nepotism) during the Orde Babu of President Suharto in Indonesia, is all what would be called ‘new money’; snobby, demi-aristocratic ‘old money’ derived from such uncomfortable businesses as dealing in slaves: the wealthy families of the American northeast and London amassed their fortunes from the ‘Triangular Trade’ …

… but one presumes that time, and forgetfulness, and philanthropy, and good PR, clean dirty money. Even if it was made off of slavery, or smuggling whiskey down from Canada, where President John Kennedy’s father worked in cahoots with gangsters (and may have eventually led the Mafia to plot the death of the President).

It carries the ring of truth but is not precisely the way the system works:

Behind Every Great Fortune is an Equally Great Crime

Jay B. Barney David Schmidtz

DOI:10.1093/oso/9780198825067.003.0010

This chapter examines the accuracy of the quote “behind every great fortune is an equally great crime”, attributed to Balzac. In our times great individual fortunes are generally generated via the instrument of the business firm. The question then becomes when are firm profits a crime? Firm profits are, in general, explained by one or more of three factors: luck, efficiency, and collusion. While it is difficult to regard luck as a crime, luck does not reflect merit. Profits due to efficiency seem like the least problematic case, and collusion seems the clearest case of when fortune coincides with crime. A variety of cases lie, at least in a dynamic sense, at the intersection of the three conditions. Unfortunately, history suggests that big business and big government can collude to keep profits flowing to the former and contributions flowing to the latter. While luck and efficiency may help initiate wealth, the system tolerates connivance, making Balzac’s statement more plausible than it ought to be.

Another reason spectacular displays of wealth are held in contempt by the truly rich is that ‘the wealthy are stealthy’, often hiding away their fortune from the eager hands of the taxman, relatives, ex-wives, whoever. Private banking is a worldwide business; today, however, bit by byte, governments are tracking down undeclared wealth, seizing it and punishing its owners.

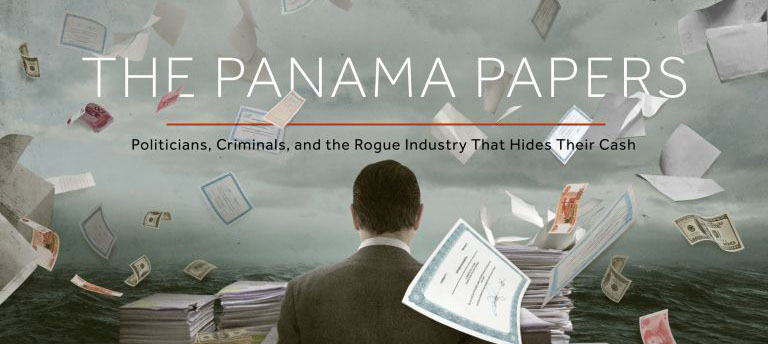

How do blacklisted companies accused of funneling resources into war zones continue to do business? How do criminals maintain companies behind a veil of secrecy? How do corporations try to dodge millions in taxes while impoverished governments struggle to provide citizens with basic health care?

Behind many major global scandals in recent decades has been one common thread: the shadowy world of offshore finance. The Panama Papers exposes the inner workings of this secretive industry through an investigation based on more than 11.5 million leaked records from a little-known but powerful law firm based in Panama: Mossack Fonseca.

Too bad for the rich crooks: in the Information Age, secrets have a way of leaking out. And secrets about money, sex or abuse of power are particularly prone to spread like … a virus …

Wealthy Chinese are notoriously secretive, and this has gained them a bad rep, similar to the dislike of Jews in many societies: they around seen as clannish, exclusivist, manipulative and tight with their charity. It is generally accepted that just before the great crash of 1997, when the Indonesian economy went into a tailspin, 300+ banks shrank to a wobbly 20, the extremely efficient ‘intelligence network’ of the ethnic Chinese saw trouble coming and moved their fortunes offshore as quickly as they could (thereby exacerbating the crisis). The conglomerates’ money was safe in Vanuatu or the Isle of Man or Hong Kong; their shareholders in Indonesia were left destitute, holding the bag. After the economy stabilized they quietly moved back in and purchased collapsed companies (many of which they had owned, and ransacked) for pennies on the dollar. Some of the biggest names in Indonesia today are guilty of this ‘legal swindle’, but since they have politicians in their pockets nobody says a word.

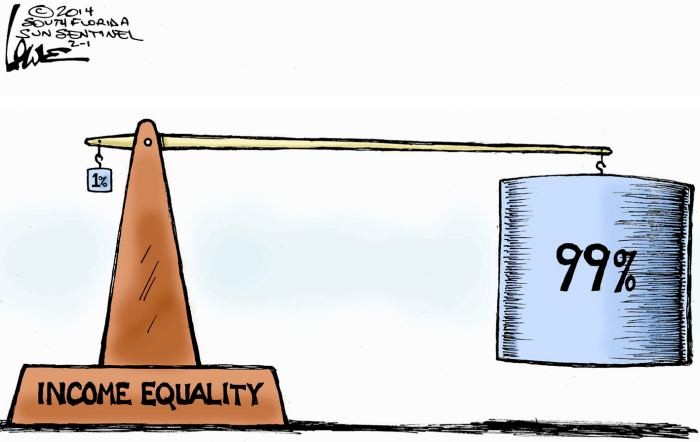

In Indonesia, as in most of the world, the rich get richer and the poor get the stick.

So when the taxman moves in, or Big Government starts breathing heavily down your neck, you gather up your pearls and furs and head for the family 757. Make your escape, rich crook.

But dear me – where to fly to? It used to be you could zip off to Brazil or Argentina and they could not touch you… but those times are gone forever. Ask Julian Assange or Edward Snowden (neither or whom were obsessed by money – Snowden gave up a $200,000 / year job in Hawaii to blow the whistle on the NSA). Wherever you flee to, you’ll face trouble. What kind of welcoming party will you get in Paraguay or Fiji, Singapore or Dubai, if you attempt to move in with your millions?

And by the way – rich people are always wondering about their millions and billions. They’re not storing them under the bed or in a family vault. They have to rely on a network of trust, involving many strangers far, far away. And that can get tricky – particularly when most money is moved online (SWIFT alone handles some US$ 5 trillion a day).

If you’re just trying to understand the volume of electronic transactions generally to an order of magnitude, it’s in the quadrillions of dollars per year. According to this document from the US Treasury, SWIFT handles about $5 trillion per day, or given about 250 business days per year, about $1.25 quadrillion dollars a year.

Similarly, CHIPS handles about $400 trillion per year, and Fedwire handles around $900 trillion per year (most of both of these arise out of SWIFT messages). These transactions make up a large fraction of electronic transactions in the world, so it’s safe to assume that the global total isn’t much more than a few quadrillion dollars a year.

SWIFT payment message volumes are usually around 11.5 million per day, giving an average payment size of around $45,000— though if one considers the structure of the payments system, it’s evident that there’s a very wide distribution of payments sizes, so this average isn’t particularly representative.

First National Bank of Chicago

In March of 1998, the Federal Bureau of Investigation brought charges against four bank employees. The case instantly became notorious because of the large amount of money involved. First National employees almost stole $70 million dollars. First National employees made plans to send the money to “dummy” accounts in Australia. Dummy accounts are anonymous and untraceable accounts. The only problem with their plan was that Merrill Lynch found more than $20 million missing from their account. Merrill Lynch immediately contacted the FBI and caught the four employees before they could make off with the money.

With that volume of dough sloshing its way from satellite to satellite or along undersea fiber optic cables there is bound to be somebody, somewhere, trying to dig it and divert some.

OK, Switzerland here we come! Uh-oh … too late … A new socialist Government means the squeeze is on the rich kids there too …

The new socialist regime in Bern is out to kill the golden calf and is succeeding. The taxes for those the socialists deem very rich are astronomical, and I foresee an exodus not unlike the one from France back in 1981, when the socialists there decided to soak the well-off. They never learn, do they?

Very few do. Free-market capitalism is the best way to support the poorest and the neediest. Just wait and see what will happen in the Bagel following the virus impact. The city is the biggest employer, and Bagelites who are municipal workers are paid by the taxes of those working in big glass buildings. The latter are now fleeing, and what I’d like to see is how the municipal workers are going to be paid. Perhaps with Noo Yawk scrip moolah. Ditto here in Gstaad.

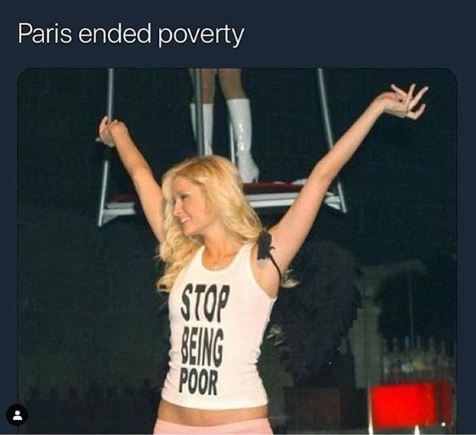

And then, as a climax (so to speak), there’s Paris Hilton.

You got it? Just stop being poor. That’s the ticket.